For individuals resolving a severe injury or wrongful death claim, there are many different investment vehicles to consider. Of course, the settlement funds resulting from such a claim are intended to compensate for a particular loss or injury unique to each case. For example, the settlement funds might be the result of an automobile injury that caused a permanent disability requiring ongoing medical treatment and countless other life changing issues. Whatever the specific case may be, it is imperative that the settlement funds provide for the needs of the individual and are not prematurely exhausted.

Recognizing the importance of protecting settlement funds resulting from an injury or wrongful death case, IRS Code Section 104 fully exempts settlement annuity payments from any taxation. Thus, when an individual receives a large settlement, a structured settlement annuity will protect the funds from premature exhaustion and maximize the investment return.

Further, when considering various investment types, one must consider such things as the risk of the particular investment vehicle, potential brokerage fees, ongoing management fees, the payment duration, and of course taxes. It is often the case, with many other investment vehicles, to assess some or all of the aforementioned fees which may or may not be fully disclosed upfront. On the contrary, structured settlement annuities will not reduce the investment return by imposing such fees.

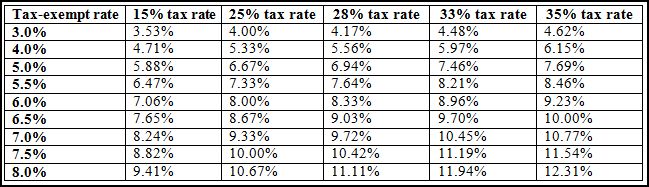

Resolving an injury or wrongful death case with a tax-exempt structured settlement annuity not only provides guaranteed payments, but also maximizes the returns. To further illustrate the significance of the tax-exempt benefit see the chart below. The first column lists example rates used for a tax-exempt settlement annuity. The remaining columns list the higher taxable yield needed to produce the same return as the corresponding tax-free settlement annuity rate; depending on an individual’s applicable tax bracket. For example, for an individual in the 28% tax bracket, it would take a guaranteed 8.33% taxable yield to match a 6.0% tax-exempt annuity.