Attorneys

You simply cannot afford to ignore structured settlements. The excuses range anywhere from the misconception that a structured settlement is just another time consuming task, to preconceived notions that all clients just want a lump sum and to move on. Other attorneys have ignored structured settlements by simply carrying the “if it ain’t broke, don’t fix it” mentality. One of the most popular reasons attorneys ignore structured settlements results from feeling that they are not sufficiently knowledgeable in the area, and do not have time to learn. All of these excuses are remedied by simply bringing in a structured settlement planner.

Aside from these misconceptions, attorneys need to remember they have an obligation to zealously represent their client and are remiss to ignore the benefits a structured settlement may provide. In fact, there have been cases where the plaintiffs’ attorneys have been held responsible for failing to present structured settlements to clients in resolving their cases.

The decision to present various options a structured settlement may provide a particular claimant should not be solely out of fear of attorney accountability. Isn’t it just good business practice in general to provide the best possible outcome for your injured client and ensure their future care? I do not think it is any secret that more than a handful of choices exist for an injured party seeking representation. If an attorney brings in a structured settlement planner to work with the injured party who presents options tailored to that party’s needs, which in turn maximizes the injured party’s recovery, it seems logical that you’re going to have a more satisfied client.

So what do you have to lose? As an attorney representing an injured party, why not consult a structured settlement planner who will work with you to ensure the best result for your client? There is no hidden agenda, or hidden costs involved, there is nothing to lose. Having a structured settlement planner costs nothing for the attorney or the client. The structured settlement planner will look at the injured party’s needs, discuss their goals and work together to present options that serve to meet those goals and maximize the settlement proceeds without prematurely exhausting the funds. Of course a structured settlement is not the best solution for every case and your planner will indicate such if it does not make sense for a particular injured party’s specific situation.

It does not necessarily have to be an enormous settlement amount in order to benefit from a structured settlement. There are many situations wherein cases settling under six-figures greatly benefit from a structure, but those benefits cannot be considered if you fail to engage a structured settlement planner.

Injury Victims – Plaintiffs

You are the reason structured settlement options exist. A structured settlement is not something created by the financial sector looking to prey upon the proceeds of your settlement funds. Rather, the government has allowed for injury victims to receive their settlements in the form of periodic payments through a tax-free income stream, with the intention of not prematurely exhausting the settlement funds. While a structured settlement is not the right option for every case, the injury victim should absolutely ask their attorney or structured settlement planner to see if their case would benefit from such.

In general, the benefit of a structured settlement through periodic payments largely depends on the type of injury and type of person in the particular case. The following types of injuries or cases are the most common that benefit from a structured settlement through periodic payments:

- Injuries requiring ongoing medical care, treatment, or rehabilitation;

- Injuries involving loss of limbs;

- Injuries involving multiple fractures;

- Injuries involving serious burns to the person;

- Injuries resulting in moderate or severe permanent disability or injury;

- Spinal cord injuries;

- Moderate to severe head injuries;

- Wrongful death.

In addition to the type of injury involved, such as those listed above, the type of person who has been injured may also help determine the suitability of a structured settlement periodic payment plan. The following general categories are merely given as examples:

- Minors;

- Elderly persons without significant income sources to provide for their care;

- Persons with physical or mental hardships or disabilities;

- Persons with poor financial management habits;

- Persons needing long-term or lifetime income streams to cover ongoing costs

- Persons without immediate need for large amounts of money.

Common Types of Structured Settlements

Another consideration of a structured settlement involves an awareness of the many different options available depending on each particular injured party’s needs and goals. A structured settlement planner is able to listen to these needs and goals of the injured party and customize a plan or present several options best suited to meet those specific needs and goals. While there are far too many ways of tailoring a plan to list them all, the following list illustrates some of the more common ways to structure settlement funds:

(Keep in mind, in any of the payment arrangements listed below, it is very common to use some of the settlement funds to immediately pay current and past expenses or bills, attorney fees, and any other immediate cash needs)

- A set payment amount received over regular intervals for life. (i.e., $2,000 per month, for life)

- A payment amount that increases periodically and are paid regularly for life (i.e., $2,000 per month, increasing 3% annually, for life)

- A set payment amount or periodically increasing payment amount, paid for life, and with a specified period of time wherein even if the claimant dies, the payments will continue through the end of that specific period of time to the claimant’s estate or to another contingent payee. (i.e., $2,000 per month, with a 20 year guaranteed payment period, wherein should the claimant die, their estate or possibly children etc., will continue to receive the payments)

- A set payment amount received over regular intervals for a fixed period of time, which will be paid regardless of whether or not the claimant is living. ($2,000 per month, for 20 years, paid regardless of the claimant’s lifetime)

- A set payment amount received over regular intervals for life, plus additional lump sum payments at specific future dates. (i.e., $2,000 per month for life, with a $25,000 payment in 10 years and a $75,000 payment in 20 years)

- Any of the above payment structures, plus the addition of specified funds for anticipated future needs such as college funds or new house funds. (i.e., $2,000 per month for life, plus $80,000 lump sum for children’s’ college expenses)

- Any of the above payment structures, plus a medical trust funded with a specific amount of money to be used for future medical expenses.

- Any of the above payment structures, plus a special needs trust to pay for any other anticipated special needs specific to a particular case)

Sample of what a Structured Settlement could look like:

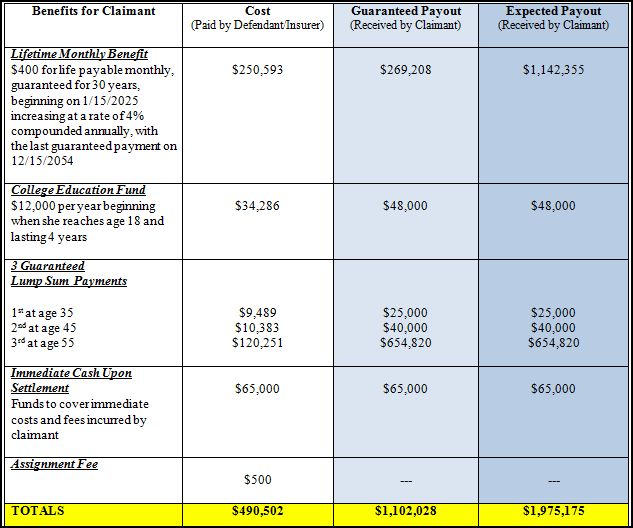

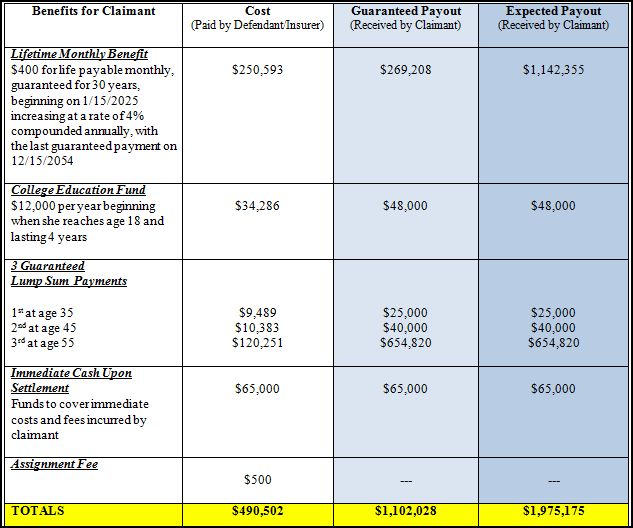

Injured Party / Claimant: A female, who is 8 years old, struck by a car while riding her bicycle suffered a broken arm and leg. The case settled for a total of $490,502. Considering her young age, and need to maximize the settlement funds a structured settlement was agreed upon wherein the $490,502 provided a guaranteed amount of $1,102,028 with an expected payout of $1,975,175 as illustrated in the chart below.

In summary, for the example given above, the guaranteed amount the claimant would receive would be $1,102,028. The expected amount the claimant would receive, based on current life expectancy estimates, would be $1,975,175. Finally, the cost to provide these funds to the claimant would be in the amount of the $490,502 from the settlement funds.

If you have any questions about this posting or would like further information relating to a particular case you have, please contact one of our knowledgeable planners who will happily assist you.

(407) 252-5156 or (877) 596-5705